ABCP Conduits: Awakening the Sleeping Giant

Feature Article: ABCP Conduits - Awakening the Sleeping Giant

Market Overview

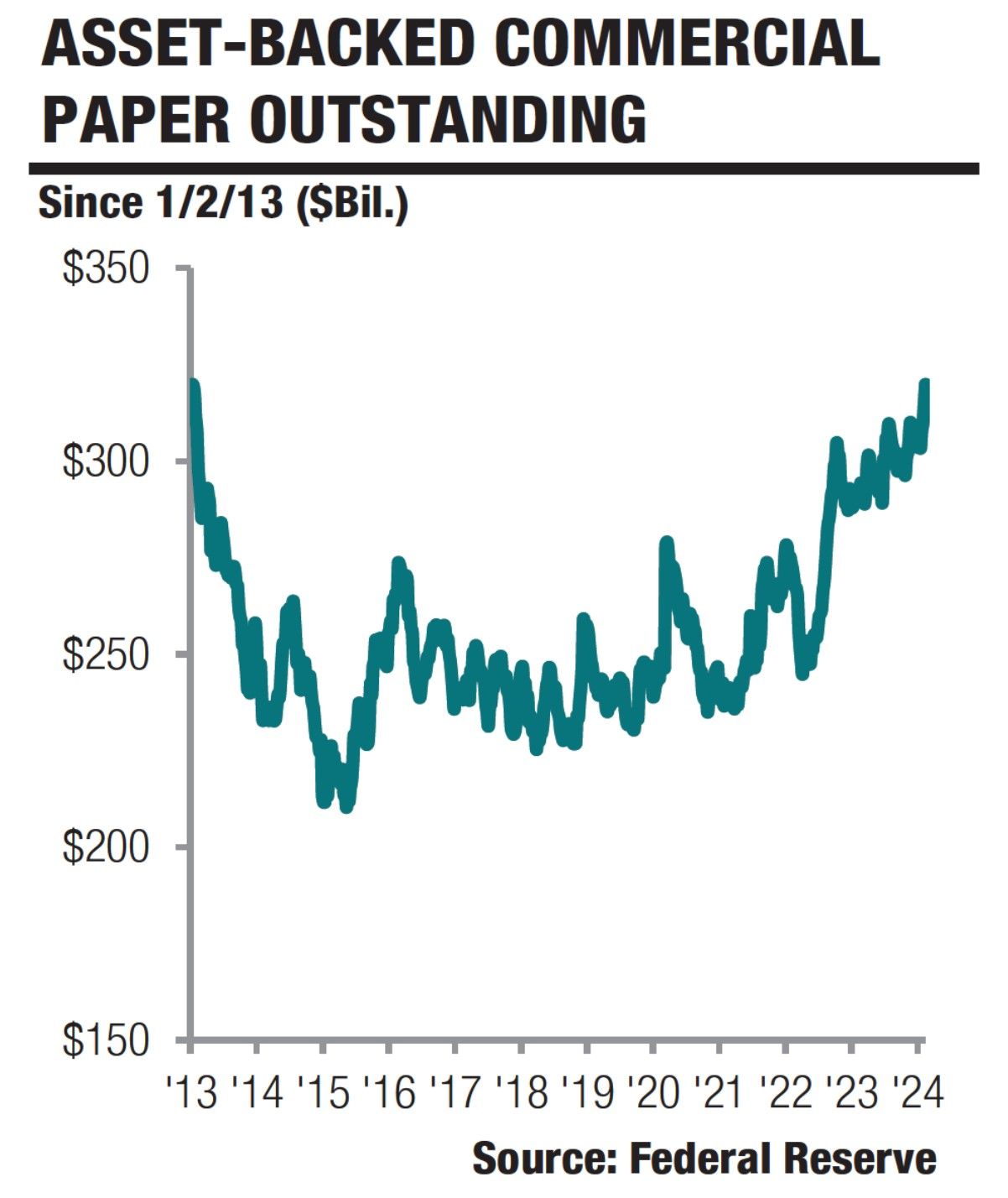

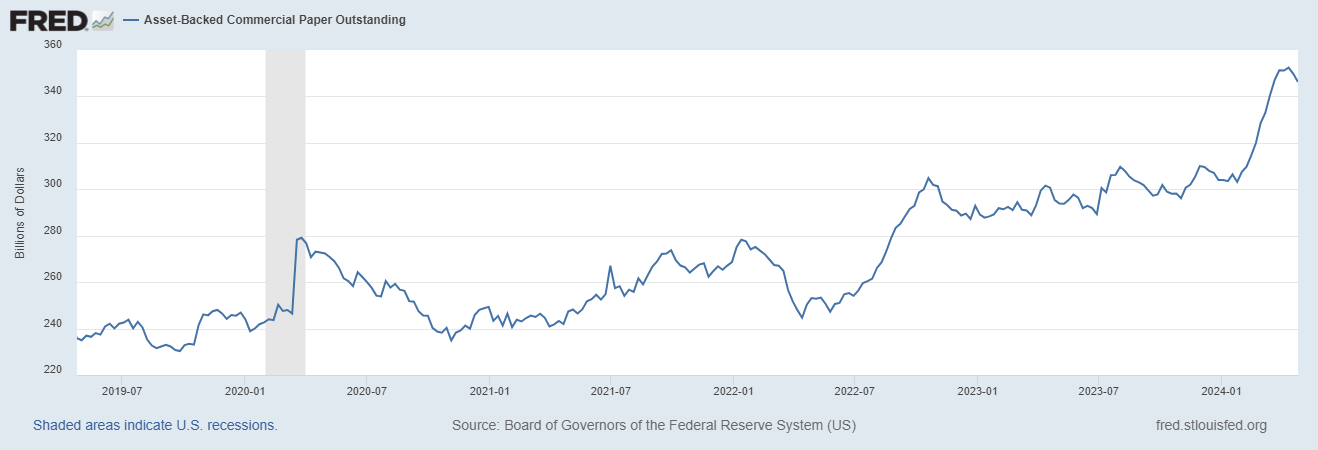

Relegated to backwater status after the Global Financial Crisis, Asset-Backed Commercial Paper (“ABCP”) outstanding has found its footing in 2024 establishing a decade high. The chart below as of April 24, 2024 from the Federal Reserve, illustrates the last five years of weekly aggregate US$ ABCP outstanding reaching US$352bn from a record low of $230bn in September 2019.

Reasons for ABCP growth?

"We see growth in US ABCP outstanding in 2024 as a result of several factors”

says Jim Metaxas, Global Head of Sales at TAO Solutions. “

This includes:

- An increase in the number of sellers and expansion of asset classes added to conduit programs by sponsors;

- With conduit programs offering a highly favourable cost of funds, there has been greater utilisation of existing conduit facilities by sellers

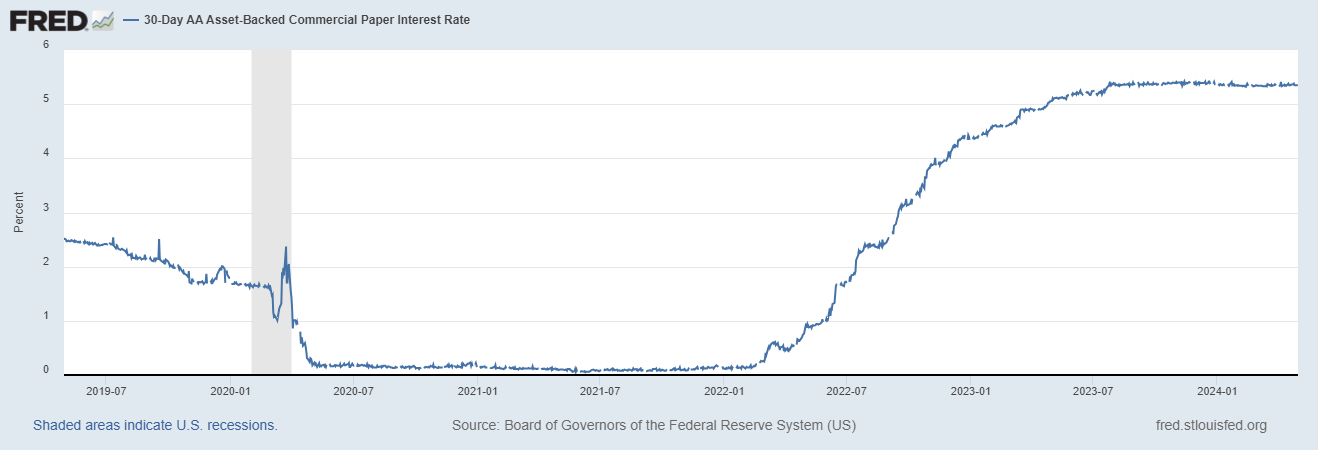

- Investor demand has been buoyant in the current interest rate environment allowing them to obtain competitive yields on short-term instruments that possess excellent credit characteristics due to, in many cases, fully back-stopped programs. The heightened yields are best illustrated in the chart below;

- A rise in the introduction of many Collateralized Commercial Paper programs utilizing derivative financing arrangements, such as total return swaps, and repurchase and loan agreements in conduits, driven by global bank demands for market instruments to bolster capital requirement ratios; and

- Productivity, throughput enhancements, and new funding capabilities delivered to conduit sponsors via software solutions like TAO Solutions’ SecureHub, to issue more complex liability instruments and to better address the complicated compliance and administration requirements.”

“Being the world’s number one ABCP administration software vendor, we are in the unique position to have a proactive understanding of conduit sponsors requirements with our technology supporting front, middle and back-office activities” says Aaron Seaton, CEO and Co-Founder of TAO Solutions.

The ABCP markets remain an important form of funding for the structured finance industry and the clients they serve. ABCP funding plays a key role in the financing of many industries and asset classes with composition of programs consisting of auto loans and leases at 28%, other 26%; commercial 15%, trade receivables 10%, consumer 8%, student loans 4%, equipment 4%, credit card 3%, and mortgages 2% (Source: S&P Global Ratings)

“Managing an ABCP conduit is a complex world unto itself requiring a multitude of capabilities including liability issuance and management, credit adjudication and surveillance, accounting, and administration and invoicing. Principally, the ability to track, project and plan ABCP issuance and rolling activities, whether match or pooled funded, and tying this back to the seller assets to determine the related sellers cost of funding remains a critical challenge for sponsors to administer efficiently. Globally, our SecureHub product is the only software platform purposefully designed to not only solve these challenges, but also to deliver new capabilities to conduit sponsors to support various and complex asset and liability permutations, including the ability to manage multi-currency market and balance sheet funding mechanisms, along with automated cost of funds determinations that include hedge and swap instruments effectively” – says Seaton.

How is technology assisting the ABCP Conduit industry?

“We see sponsors investing more time into system improvements and risk management processes to support this growing market segment. Emerging trends include the use of AI (artificial intelligence) to deal with risk assessment, forecasting and market analysis. Many sources within the industry maintain that compliance and implementation challenges continue to hinder the bank-sponsored programs, a key element that TAO Solutions has been able to address” – says Nicolas Warlop – Director, Sales and Solutioning at TAO Solutions.

“Two primary models exist for conduit operations with the first being in-house administration and the second is the use of third-party administrators. At many institutions, in-house administration and daily operations are typically Excel or proprietary legacy applications that are fraught with compliance and operational risk issues. In addition, many in-house methodologies are slow or costly to adapt to new developments in the market such as the use of observable risk-free rate methodologies (SOFR, etc.) and support for commercial paper trade optionality.

Similarly, using a third-party administrator does not always lead to better results, as they typically suffer from the same legacy system issues with difficulty in supporting complex multi-seller and multi-jurisdictional programs, and if they do, it comes at a high cost. However, with a product like SecureHub some or all front, middle and back-office ABCP conduit activities can be effectively brought in-house significantly reducing operational costs, increasing operational efficiencies, addressing compliance and risk, and eliminating duplication of efforts. Finally, API connectivity has simplified the integration of conduit activity inputs and outputs within the larger conduit sponsor institution allowing for end-to-end, auditable, straight-through results that has demonstrably improved efficiency and cost structures across many of our clients’ operations.” – says Warlop.

Solving for Multi-Jurisdictional ABCP Issuances

A key objective for any Conduit Sponsor is to obtain the lowest cost of funding for its sellers. To achieve this, it is widely acknowledged that the depth of the ABCP investor base in the United States well exceeds the UK / Europe and as such, the United States represents the main source of funding for many global Sponsors.

Supporting multi-jurisdictional ABCP issuance activities can be a challenge, particularly when the Sponsor is headquartered outside of the United States. TAO Solutions has been very successful at enabling Conduit Sponsors to address muti-jurisdictional issuances and automate both US and overseas ABCP administration activities, utilizing various funding methods. Examples include:

- Matched vs pooled

- Interest rate swaps (including the new RFR methodologies)

- Cross currency swaps

- Balance sheet lending

- Extendable / callable ABCP

- Floating Rate Note (FRN) ABCP

This automation not only includes front, middle and back-office activities but also solves the case for downstream reporting, audit and risk management. TAO Solutions can also address multi-jurisdictional regulatory requirements.

Our Forecast for ABCP Outstanding in 2024

“In summary, we see ABCP outstanding exceeding US$375bn over the course of 2024 on the basis of the information presented herein. There is a growing desire for sponsors and sellers to use this form of funding and the market dynamics should continue to see investors increasing their appetite for ABCP”. Furthermore, we understand several new ABCP conduits will be established in 2024 that will add to overall issuance activities - say’s Metaxas.

Introducing ABCP Conduit Administration - Rapid Implementation Framework

The necessity to provide a proven, turnkey industry solution that mitigates implementation risks remains a key consideration for any procurement decision. As a result, TAO Solutions has introduced an ABCP Conduit Administration - Rapid Implementation Framework, enabling our team of experienced subject matter experts an expedited implementation methodology to support a new programme or displace a legacy system.

Please contact us to obtain a copy.

Products

Solutions

Covered Bonds Programs

Structured Finance Warehouse Facilities

Regulators

Private Lending

Mortgage Quality Control & Advisory Services

Our AI Vision

Structured FInance

AI in Structured Finance

Use Cases

Digital & Technology Enhancements

Workflow Automation

AI Use Cases

Best Practices for Remote Software Implementations

Info HUB

About

©2024 TAO Solutions

Terms & Conditions | Privacy Policy | SOC 2 | ISO | Gold MS Partner